ETF Market Update: Chaos Edition

A Bit of a Reshuffle, Active Crushes, and a new Black Hat Stinker

Another month, and the world didn’t actually end. I’m counting my blessings.

Here’s the quote:

ETF investors have put another $50 billion to work since the April lows, with big wins for active management, short-dated bonds, non-U.S. equities and “safety” plays like gold, and, shockingly, Bitcoin? This month’s un-ownable Black Hat ETF is the The Defiance Levered Long+Income Strategy ETF (MST), a movie-monster mashup of (Micro)Strategy, wildly unpredictable leverage, randomly distributed income, unknowable tax treatment and shameless fees (Black Hat). Thankfully, we can give the White (or at least Gray) Hat to the Capital Group KKR Core+ Public-Private credit Interval Funds, which might make both private credit and interval funds palatable for the first time.

- Dave Nadig, Independent ETF Expert

I started looking at ETF flows on May 1st like every ETF pundit, and decided it was exactly the wrong date. Between window dressing, index rebalancing and various derivatives based structural flows, it’s hard to tease sentiment out around a calendar marker. So this is all for the Month ending May 7th, 2025, or a month from recent lows.

Let’s dig in.

Credit Collapse? Or Safety Zone?

The amazing Matt Bartolini, Head of SPDR Americas Research at SSGA, produces one of the best monthly briefs on the ETF market out there. Here’s the excellent chart:

His point: the previous year and change was amazing for three credit categories of Investment Grade corporates, Junk, and the Super-Junk in the Loan and CLO markets. The promise has been “yield yield yield,” which is also the default marketing message for everything from short term treasury funds to crazy income products using leverage and options (Such as $MST, which I cover in depth below the fold).

But as markets got wonky in the last month, folks headed for, if not the exits, more well understood alternatives to SPY, like short term government bonds and international equity.

It’s not that investors went “risk off” in the traditional sense, it’s that they rotated their intra-asset class tilts. Gold, Bitcoin, and short duration bonds essentially absorbed all the selling from Small cap equity (-$5.8 billion), Cyclical sectors (-$52 billion), Long bonds (-$4.7B) and China (-$3.7B).

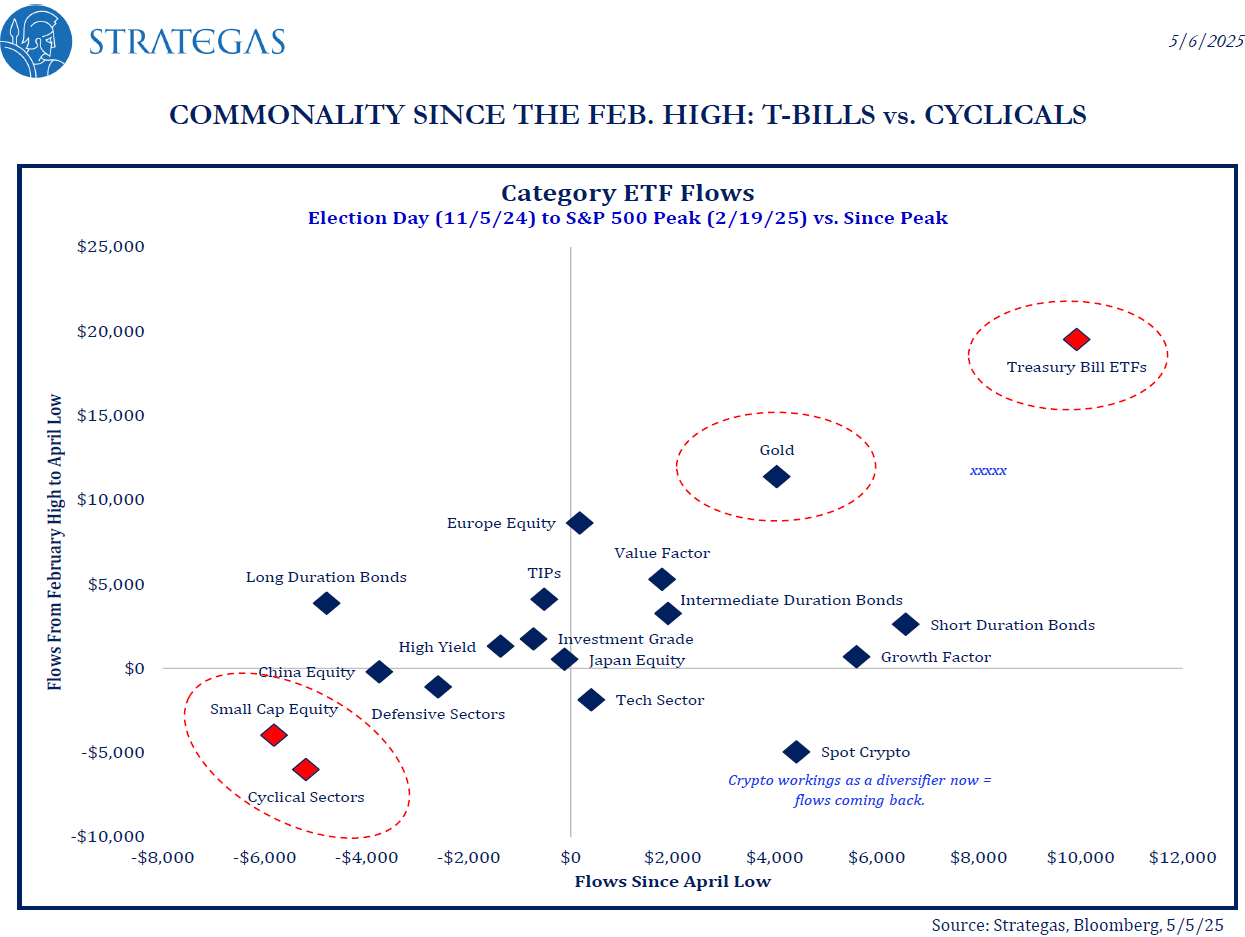

In thinking about how this compares to recent history, I thought this awesome chart from Todd Sohn at Strategas made an interesting point:

Which is — the big winners and losers were set a while ago: safety plays winning (a category which newly includes Bitcoin), small caps and cyclicals bleeding. It’s consistent enough to call a trend.

Fees Matter Again

So what’s new? The era of super expensive products gaining assets seems to be coming, if not to an end, to a pause…