I really hate seeing a firm slide into black hat territory, but that’s what Simplify has done over the last few weeks.

The story is simple: Simplify launched a 15bps money-market ETF (T-bills+Repos), SBIL, that seemingly overnight went from nothing to $2.1 billion. It should be the most boring ETF launch in history, except it’s not, because it’s really just a money grab on their own shareholder base.

Here’s the quote:

Funds owning other funds in the same family isn’t new, but Simplify’s recent SBIL launch reaches a new level of greed-before-good. What used to be included cash management services inside the firm’s derivative-based strategies (like CTA), is now a behind-the-curtain 15bps add-on that shareholders didn’t ask for, but are now paying for. I’m not sure this is the “innovation” investors needs.

- Dave Nadig, Independent ETF Expert

Acquired Fund Fees & Expenses

The problem with SBIL isn’t the fund — cash funds aren’t that interesting, and 12-15 bps for a cash product isn’t absolutely insane (just mostly insane).

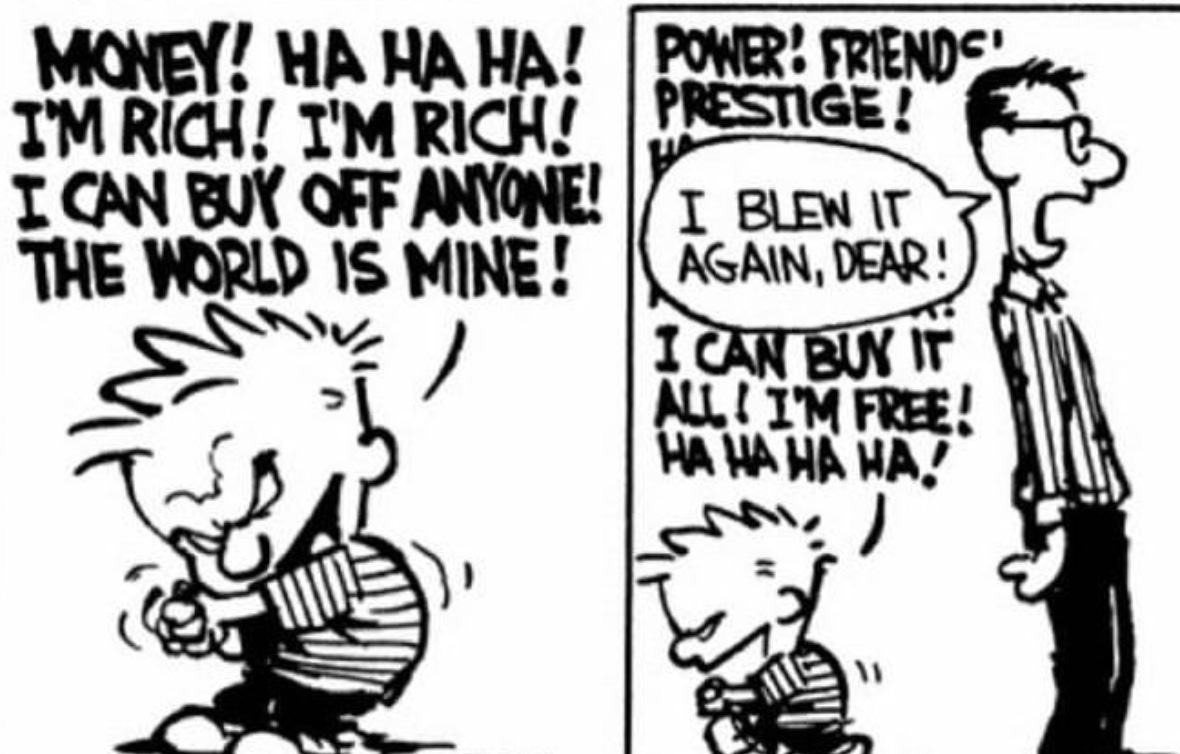

The problem is that Simplify’s end investors now “own” the $2.1 billion at 15bps inside other Simplify ETFs, which is a fee hike on most of their existing shareholder base (and has the side effect of balooning their apparent firm size in a matter of days.) It’s a nice way to manufacture $3 million in annual fee revenue I guess, but just like tariffs, it’s always us suckers who pay. Cascading fees like this are the ultimate black hat move.

(Details and Conclusion Follow below the paywall)